Your Mortgage Journey Made Simple: Apply With Confidence!

Enhanced tools and resources along with personal guidance to make your mortgage journey seamless.

Navigating The Mortgage Process With Confidence

Applying for a mortgage can feel like a daunting journey. Many people face uncertainties about the process and fear making mistakes, which can lead to unnecessary stress. As a dedicated mortgage professional, I’m here to make things easier. By offering clear, personalized guidance, my mission is to turn your dream of homeownership into a smooth and stress-free reality.

Navigating the Overload of Information

With so much advice about mortgages online, it’s hard to tell what’s accurate and helpful. Outdated, overly generic, or incorrect guidance only adds to the confusion. That’s why I cut through the noise to provide reliable, actionable insights. You’ll receive clarity and confidence every step of the way.

Tailored Support, Just for You

Every client has unique needs and goals. That’s why I prioritize learning about your financial aspirations, lifestyle, and concerns through thoughtful questions. This allows me to customize the mortgage process to fit your situation perfectly, ensuring you feel empowered and informed at every stage.

A Foundation of Trust

Mortgage decisions are significant, both emotionally and financially. Unlike companies focused solely on profit, I put people first. When you work with The Todd Hanley Mortgage Team, you’re not just a file—you’re an individual with dreams that matter deeply to me. Authenticity and commitment drive everything I do, so you can trust me to follow through and make a positive difference.

What Sets Us Apart

I’m proud to offer competitive terms, but my dedication goes beyond numbers. With over 15 years of experience, I provide unmatched expertise, a people-first approach, and unwavering dedication to your success. Here’s what you gain with us:

Unrivaled Dedication - I go the extra mile for a seamless experience.

Expert Guidance - Decades of knowledge to navigate any challenge.

A Partner in Your Journey - Your goals are my top priority.

Let’s Make Your Journey Easier

Applying for a mortgage doesn’t have to be overwhelming. With my expertise, authenticity, and commitment to exceptional service, I’ll help you take confident steps toward your dream of homeownership. Start your journey with The Todd Hanley Mortgage Team today and experience the difference firsthand.

Why Choose Us?

Save up to $10,662!

A recent Polygon Research study found that consumers save an average of $10,662 over the life of the loan when working with an independent mortgage broker as opposed to a nonbank retail lender.

Vast Knowledge Base

With dual licensing, Todd understands both the housing market and mortgage financing inside and out.

Better Offer Acceptance Rates

We love to win! And, we know how to. When it comes down to you prevailing in a competitive market scenario, we pull out all of the stops to enhance your odds above everyone else.

Always Available

From start to finish, we’ll be available mornings, the weekends and evenings to answer your questions and keep the process moving seamlessly.

What People Are Saying…..

"Todd is a consummate professional that guided and advocated for me, an active duty military member, through my first home-purchasing experience. I asked Todd many questions throughout the process. He is extremely knowledgeable, patient, and timely with his actions, including matching very competitive loan offers from other lenders. As someone who has recently moved to the area, it can be hard to find people who are quality people and professionals; Todd meets and exceeds both of these standards. I fully recommended Todd Hanley to the military and civilian communities who are looking for his services throughout the homebuying process."

— Kody K

"Todd has earned my highest recommendation. He has helped me close on two houses and sell one house. Working with Todd is a pleasure, with his patience, expertise and guidance he makes you feel like family and to be comfortable with these big milestones. He truly cares and is passionate about what he does and it shows throughout the entire process. I would choose Todd Hanley every time for anything home buying related. He’s the best, why try the rest!"

— Leran R

"Todd is the best! Took what seemed like a very complicated and nearly impossible ask and turned it into 2 very happy parents moving into their new condo. Very attentive and leaves no stone unturned when trying to fit you with exactly what you need. Will work together again soon. Strongly recommend."

— Jason Z

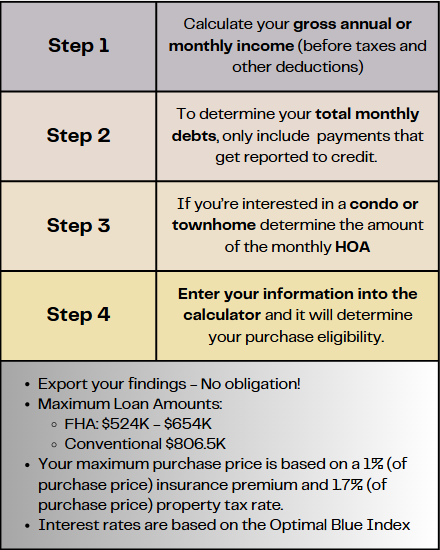

Florida Homebuyer Eligibility Calculator

Instant Pre-Qualification Calculator

Are you ready to apply?

1.Scroll the section below and use the Mortgage Application Document Checklist to determine which items will be required for your application. Gather and organize your items in preparation to upload for review.

2. Click here to start your mortgage application (will be brought to a new site).

3. Submit your completed application and upload your required documentation into the portal for review.

4. Your application will be reviewed the same day (if submitted prior to 7pm eastern)

5. Opt-Out as soon as possible. Click HERE for more information.

FAQ: Applying for a mortgage - what to expect!

1. What types of mortgages are available?

Common mortgage types include fixed-rate, adjustable-rate (ARM), Conventional, FHA, VA, USDA, Non-QM and jumbo loans.

2. What are the minimum credit score requirements for a mortgage?

Minimum scores vary by loan type. FHA and VA can go as low as 500. Meanwhile, conventional requires a 620 and other loan programs can be even higher.

3. What documents do I need to apply for a mortgage?

You'll generally need proof of income (paystubs + W2’s), tax returns if self-employed, bank statements, employment verification, and credit reports.

4. How much down payment is required?

Down payments range from 0% for VA and USDA loans to 3–20% for conventional and FHA loans, depending on the program and your qualifications.

5. What is pre-approval letter, and how can I get it?

A Pre-approval letter is a lender's evaluation of your borrowing capacity. It requires filling out a mortgage application, submitting financial documents and undergoing a credit check.

6. What’s the difference between pre-approval and pre-qualification?

Pre-qualification offers an informal estimate of your loan eligibility, while pre-approval is a formal review based on your financial details and credit report.

7. What factors determine my mortgage interest rate?

Key factors include your credit score, loan type, loan term, and prevailing market conditions.

8. What is private mortgage insurance (PMI), and when is it required?

PMI protects lenders when borrowers put down less than 20% on a conventional loan. FHA loans require a monthly MIP (mortgage insurance premium) and an upfront (UFMIP) regardless of the amount of your downpayment.

9. Are there special programs for first-time homebuyers?

Yes, I have multiple First-Time Homebuyer programs that provide downpayment assistance, lower mortgage rates and mortgage insurance as well as lower downpayment requirements.

10. What is an escrow account?

It’s an account where funds for property taxes and homeowners’ insurance are held, often included in your monthly mortgage payment.

11. How is my loan amount determined?

Your loan amount is contingent upon the amount of your downpayment, credit qualifications and debt-to-income ratio requirements.

12. What is the loan-to-value (LTV) ratio?

The LTV represents the percentage of debt owed in proportion to the home’s value. For example, a home with an $80K balance and a value of $100K has an LTV of 80%.

13. What are closing costs, and who pays them?

Closing costs represent the fees or costs of the processes or services that need to take place before your loan can be approved. Credit reports, appraisals, loan processing & underwriting and title insurance all cost money and are required to close a mortgage loan. The buyer is typically responsible for their portion of the closing costs. In some counties the seller pays for the new owner’s title insurance.

14. Can I buy a home with no down payment?

Yes, eligible borrowers can access no-down-payment options through VA or USDA loans. I also have an FHA option that does not require you to be a first time homebuyer.

15. How does my debt-to-income (DTI) ratio impact loan approval?

DTI measures your total monthly debt against your gross monthly income. This is one of the most important factors in qualifying for a mortgage and is greatly affected by your credit score and the desired loan program.

16. What is an appraisal, and why is it required?

An appraisal is a report of the property’s value and condition. Think of it as the eyes and ears of the lender you’re using to obtain your mortgage loan.

17. What are the requirements for USDA loans?

USDA loans are for rural properties and involve income limits, property location restrictions, and borrower eligibility criteria. Reach out to verify your desired homes eligibility.

18. What is a rate lock?

A rate lock secures your interest rate for a set time, protecting you from market fluctuations.

19. What if my mortgage application is denied?

You can appeal, address the issues (e.g., improve your credit), or apply with a different lender. The least favorite part of my job is telling people, No. Therefore, I will do everything I can to approve you. If there is not a pathway to approval, I will provide you with instructions on what steps you can take.

20. Can I include renovation costs in my mortgage?

Yes, options like FHA 203(k) and Fannie Mae HomeStyle loans let you finance home improvements.

21. Are you allowed to use gift funds?

Yes. You are allowed to use gift funds on most loan types. FHA, VA and conventional allow unlimited gift funds from eligible sources. For more details please reach out!

22. What is a soft credit pull?

A soft credit pull is one that allows full access to your credit report without showing up as an official inquiry. Due to drastically increasing credit report costs most, if not all lenders and mortgage loan officers are using some form of a soft pull. A hard pull on the other hand is an official inquiry on credit and can affect the score.

When it comes to securing a mortgage, you deserve nothing less than the absolute best—and that's exactly why you should consult with Todd Hanley for your needs. With over 16 years of experience as a Senior Loan Officer, Todd brings unmatched expertise to the table. Being recently featured in The Wall Street Journal, what truly sets him apart is his holistic understanding of the real estate and financial landscape affecting homeowners like you.

- Active Real Estate License: Todd holds an active real estate license mainly to gain access to information and data that makes me more effective at as a mortgage broker.

- Todd is designated a Certified Mortgage Advisor which is a mortgage industry professional who has been extensively trained in all aspects of mortgage backed securities, treasuries, and bonds and is an expert advisor who helps consumers understand how to use mortgage debt to build sustainable, lifelong wealth.

By choosing Todd Hanley, you're not just getting a loan officer; you're partnering with a seasoned professional who has equipped himself with the knowledge and skills to provide the most effective and personalized solutions for your mortgage needs. His unique blend of qualifications ensures that every aspect of your journey is handled with the utmost care, expertise, and integrity.

Don't settle for ordinary when you can have extraordinary. Contact Todd Hanley today for peace of mind for all of your mortgage needs.

- Phone - 954-806-5114

-Todd.Hanley@uniteddirectlending.com